Table of Contents

Good Credit Score carries so much significance as it determines how creditors interact with you whenever you apply.

It is your credit score that tells the story of how you have been handling your bills and debts, thereby giving the potential creditor an idea of what to expect if they approve your credit card, grant you a loan, or let you rent an apartment.

Your credit determines whether you will get approved for credit cards/loans with low-interest rates and other favorable terms, or if you will even get approved at all.

It is pertinent that you take very good care of your credit score and keep it in good condition.

A good way to go about this is to ensure that you settle your bills on time and avoid defaulting on payments. Settling your bills late or defaulting on loans can harm your credit score, which will have adverse effects on your future financial dealings, especially when you need to get approved by a creditor.

A good credit score has numerous benefits including lower interest rates, lower insurance premiums, access to higher borrowing limits, and so on.

There is a lot that you need to know about credit scores so you will understand what a good one is and how to manage it.

Without further ado, here is All You Need to Know About A Good Credit Score.

Understanding What a Credit Score is

When you apply for a loan or ask to rent an apartment, you are proposing that the lender/landlord trust you to make timely payments without being reminded or forced.

Before the creditor can accept this proposal, they would want to know about your previous financial dealings, i.e. how you have managed your bills and debts in the past. This is supposed to give them an idea of how you manage money.

Now, since they can’t reach out to every credit card issuer, loan company, or utility company that you have dealt with in the past, the only way for them to get this information is to pull your credit score.

Your credit score is a three-digit figure that shows your history of owing and settling debts. It is a representation of how you have handled your previous debts. The higher your score, the better you look to creditors. A high credit score shows that you have been diligent with your payments in the past and can be trusted to settle your future debts.

Creditors take the status of your credit score seriously, so much so, that a poor score can prevent you from getting approved for a loan or a credit card, or renting an apartment.

Even if you do get approved with a poor score, you would be required to pay a ridiculously high interest rate on the loan/credit card. This is because a bad score shows that you are not usually diligent when it comes to setting your debts, which increases the risk that the creditor is taking on.

Therefore, having a healthy credit score is the only way a creditor will approve your application and charge you a low-interest rate.

Although credit scores are usually discussed as a single factor, each person has more than one credit score.

Your credit score will often vary depending on factors such as:

- The credit report agency (CRA) that provides your score.

- The credit scoring model used by the CRA providing your report.

- The type of loan for which you are applying.

What is a Credit Scoring Model?

A credit scoring model is the scoring system that is employed when it comes to calculating your credit score. The most commonly used one is the FICO credit scoring model, which was designed by the Fair Isaac Corporation. Lenders/Creditors have been using FICO scores to evaluate people’s creditworthiness since 1989.

Aside from FICO, there is another credit scoring model known as VantageScore, which was designed by the three credit bureaus – Equifax, TransUnion, and Experian. The various reports provided by these models tend to differ because each of them uses different algorithms to calculate credit scores.

All You Need to Know About A Good Credit Score

Having a good credit score comes with numerous benefits including the assurance of approval when you apply for a loan or a credit card. It also helps your chances when you are trying to rent an apartment or get utility.

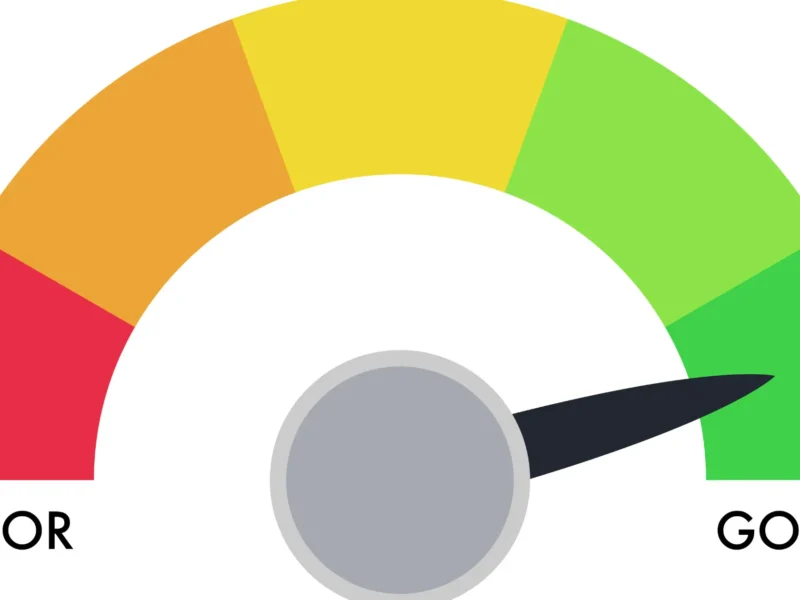

Credit scores often range from 300 to 850, with 300 being very bad and 850 being excellent. They usually vary based on the credit scoring model employed (FICO or VantageScore) and the credit bureau (Experian, Equifax, and TransUnion) that pulls the score. This takes us to the two scoring models adopted by lenders.

FICO scoring model

- 300 – 579: Poor

- 580 – 669: Fair

- 670 – 739: Good

- 740 – 799: Very good

- 800 – 850: Excellent

Vantage Score

- Below 500: Very Poor

- 500 – 600: Poor

- 601 – 660: Fair

- 661 – 780: Good

- 781 – 850: Excellent

Factors Considered When Calculating Your Credit Score

Depending on the scoring model used, below are some of the factors considered in the course of calculating your credit score:

1. Your previous debts and how you handled them.

2. Your present debts.

3. Loans that you have taken in the past.

4. Your credit cards and store cards.

5. Credit accounts that you have opened and closed.

6. Bankruptcy.

7. Your current credit limit.

8. The length of your credit history.

Causes of Bad Credit

1. Late payments: One of the fastest ways to ruin your credit is to run behind on your payments. Generally, your payment history constitutes 35% of your credit score.

Therefore, making late payments can significantly harm your credit, especially if the creditor reports you to the credit bureaus and it gets recorded in your report.

2. Closing a credit card account: Deciding to close a credit card account because you are not using it is a decision that can harm your score. This is because it reduces the total credit limit available to you.

3. Making numerous applications for new lines of credit: Every time you apply for a new line of credit, the creditor will do a hard inquiry on your credit, and this will negatively affect it.

The effect might not seem significant the first few times but an accumulation will eventually cause serious harm (to your credit).

4. Outstanding payments: Leaving numerous outstanding debts on your credit report rather than taking care of them is another cause of bad credit.

5. Bankruptcy: An accumulation of many debts that you are unable to settle may force you to file for bankruptcy. Although this move will help you get legal protection against your creditors, it will also have an incredibly damaging effect on your credit score.

Creditors in the future will be skeptical about approving the application of a borrower who has previously filed for bankruptcy.

How to Improve a Bad Credit Score

If your credit score has been harmed due to one reason or the other, below are certain ways that you can improve it as soon as possible.

1. Avoid late payments: One of the fastest ways to improve your credit score is to cultivate the habit of paying your bills on time. Try to avoid incurring debts through late payments. If you can keep this up, your credit score should get better in no time.

2. Deal with inconsistencies on your report: As you go through your credit report, look for any inconsistencies that might be there, and take the necessary steps to correct them.

3. Settle outstanding debts: If you have any debts that you are yet to settle, ensure to take care of them as soon as possible to help improve your score.

4. Avoid regular credit applications: Unless you need to, avoid applying for credit regularly. This is because every time you apply, lenders will do a hard inquiry which could potentially harm your score.

5. Avoid closing unused credit cards: To avoid damaging your score any further, avoid closing credit cards that you are no longer using. Instead, try to use them sometimes to show that you are still using it.

Ways to Check Your Credit Score

Below are some of the ways to check your credit score:

- Banks.

- Credit Karma.

- Experian.

- Mint.

- Credit card companies.

Benefits of Having a Good Credit Score

1. Lower interest rate: One of the elements that are used to calculate the cost of a loan is the interest rate that will be charged on it. Having good credit improves your chances of getting a favorable interest rate from creditors, which would translate to you paying less to settle the loan.

2. A higher chance of your application being approved: Having good credit increases your chances of getting a credit card or loan approval, as it signals to creditors that you can be trusted to make timely payments to service your debt.

3. You can apply for bigger loans: You can leverage a good credit score to apply for bigger loans compared to a borrower with poor credit. They believe that the risk involved in lending you money is low, which is why they will gladly grant you a bigger amount.

4. You will have an easier time renting an apartment: When your credit is good, it shows your potential landlord that you’ve always been faithful with your payments, which means they won’t have a hard time getting their money from you. This makes it easier for you to get approved for a new place.

5. Better insurance rate: A good credit score will fetch you lower premiums when you apply for insurance. This is because the insurance provider considers you less risky compared to applicants with lower credit scores.

6. Utility acquisition without security deposits: Since utility bills are expected to be settled at the end of the month, utility companies would naturally want to be sure that you will keep your end of the bargain.

This is why they would often take a look at your credit history to see how you have handled your previous debts. If you have a poor credit score, you might be required to pay a security deposit before they can approve you.

To Draw The Curtain

A good credit score makes it easy to get approved by credit card companies, utility companies, landlords, loan companies, and other creditors.

Your credit score tells creditors whether you are good or bad at making payments. A good credit score says you settle your debts on time while a bad one says you tend to default on your bills and debts.

Whether you would have a good credit score or a bad one depends on the decisions you make regarding your finances.

The point of this helpful article is to help you understand All You Need to Know About A Good Credit Score.